Depreciation charge calculator

Rate is used to calculate depreciation of individual assets of a firm. Of course you will still be able to sell it to individual buyers but its market value will be extremely low.

Depreciation Rate Formula Examples How To Calculate

You can use this tool to.

. Office equipment computers laptop notebook gateway compaq dell pc computer drive cd rom desktop. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Users can see the accurate value of the depreciation expense end book value and depreciation rate.

Find the depreciation rate for a business asset. However different cars depreciate at different rates with SUVs and trucks generally holding their value longer than other types of vehicles. Calculate depreciation for any chosen range of periods and create a variable.

You can also calculate the depreciation by using the table factors listed in. Assets such as plant and machinery buildings vehicles and other assets which are expected to last more than one year but not for infinity are subject to depreciation. The MACRS Depreciation Calculator uses the following basic formula.

It provides a couple different methods of depreciation. This calculator helps to share your calculations by URL. According to this particular study the average five-year depreciation rate of vehicles in the US.

According to a 2019 study the average new car depreciates by nearly half of its value after five years. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Depreciation rate finder and calculator.

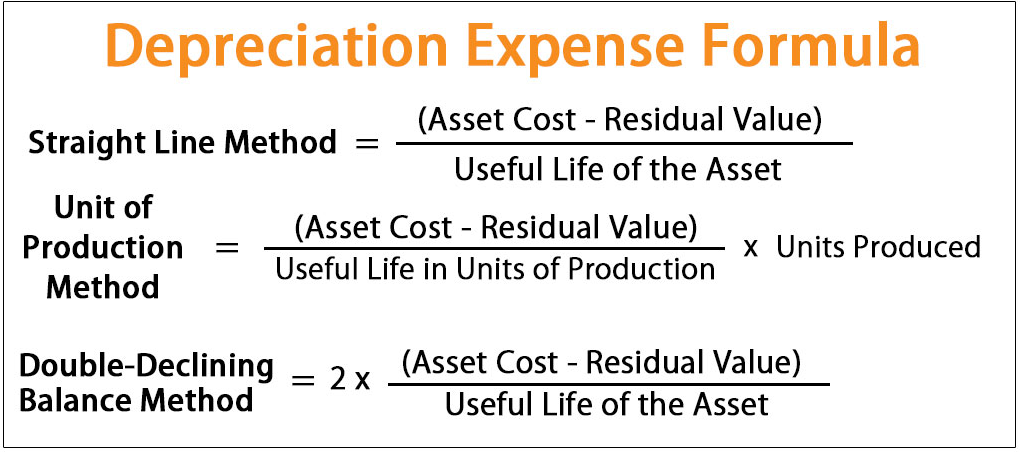

Calculation of Depreciation Rate The reduction in value of an asset due to normal usage wear and tear new technology or unfavourable market conditions is called depreciation. This depreciation calculator will determine the actual cash value of your Television - Color using a replacement value and a 12-year lifespan which equates to 012 annual depreciation. C is the original purchase price or basis of an asset.

Combined declining balance method and straight line method. Non-ACRS Rules Introduces Basic Concepts of Depreciation. The Depreciation Calculator computes the value of an item based its age and replacement value.

Our car depreciation calculator assumes that after approximately 105 years your car will have zero value. Percentage Declining Balance Depreciation Calculator. Used cars also depreciate slower than new ones keeping more of their resale value in comparison.

Section 179 deduction dollar limits. For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. Appliances major television color picture tv widescreen big screen.

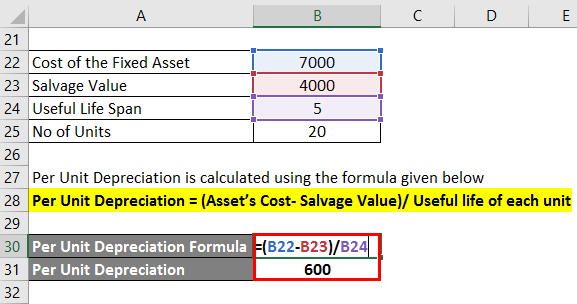

First one can choose the straight line method of depreciation. It helps to calculate depreciation expense and end book value of the asset. Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost 1Life Variable Declining Balance Depreciation Calculator.

The calculator should be used as a general guide only. Depreciation is a non-cash expense so cash-flow of the firm is not affected by the d. Rate can stay fixed for the entire life of an asset or vary as per the usage of the asset.

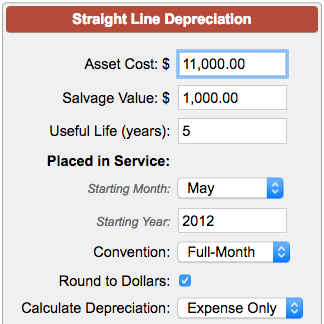

There are many variables which can affect an items life expectancy that should be taken into consideration. What can you do with Depreciation Calculator. With this method depreciation is calculated equally each year during the useful life of the asset.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation. This depreciation calculator is for calculating the depreciation schedule of an asset.

Electronics - Television - Color Depreciation Rate. And also can see the end book value in words. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years.

Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method. The second method is the declining. You can browse through general categories of items or begin with a keyword search.

D i C R i. Ri is the depreciation rate for year i depends on the assets cost recovery period. Where Di is the depreciation in year i.

View the calculation of any gain or loss on sale on the disposal of an asset when appropriate. Is around 502 percent.

Depreciation Expense Calculator Cheap Sale 55 Off Www Ingeniovirtual Com

Declining Balance Depreciation Calculator

Straight Line Depreciation Calculator Double Entry Bookkeeping

Car Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator

Depreciation Calculator Store 60 Off Www Wtashows Com

Depreciation Expense Calculator Hot Sale 53 Off Www Ingeniovirtual Com

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Depreciation Expense Calculator Cheap Sale 55 Off Www Ingeniovirtual Com

Depreciation Expense Calculator Cheap Sale 55 Off Www Ingeniovirtual Com

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Examples With Excel Template

How To Calculate Depreciation Expense Accounting Basics Cpa Exam Content Writing

Depreciation Rate Calculator Online 60 Off Www Ingeniovirtual Com